What Is Wrapped Ethereum (WETH)?

WETH is the wrapped version of Ether. Wrapped tokens, like WETH or Wrapped Bitcoin, are tokenized versions of cryptocurrencies that are pegged to the value of the original coin and can be unwrapped at any point. Almost every major blockchain has a wrapped version of its native cryptocurrency like Wrapped BNB, Wrapped AVAX, or Wrapped Fantom. The mechanism of such coins is similar to that of stablecoins. Stablecoins are essentially “wrapped USD” in the sense that dollar-pegged stablecoins can be redeemed for FIAT dollars at any point. In a similar fashion, WBTC, WETH, and all other wrapped coins can be redeemed for the original asset at any time.

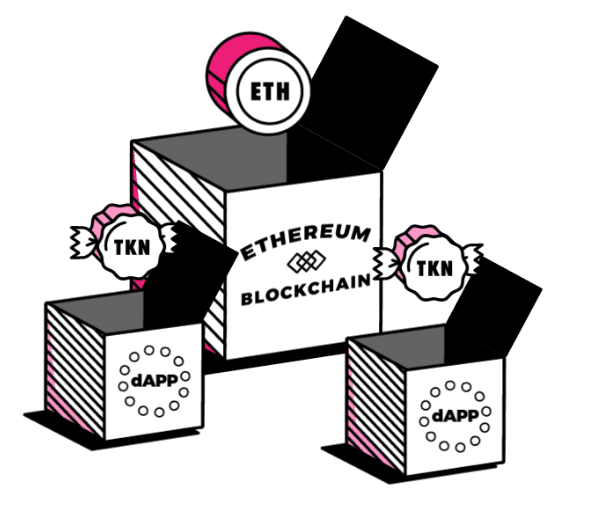

Wrapped coins solve a particular problem: because of the low interoperability of blockchains, native coins of one chain cannot be used on another chain. For instance, you cannot use Bitcoin on the Ethereum blockchain and you cannot use Ether on Bitcoin or Avalanche. Wrapping coins solves this problem by tokenizing them and applying the blockchain’s token standard to the tokenized version of the original cryptocurrency.

On Ethereum, almost all fungible tokens follow the ERC-20 standard developed in 2015. This token standard was developed to have a standardized set of rules for tokens on Ethereum, which simplified new token launches and made all tokens on the blockchain comparable to each other. Mandatory rules all ERC-20 tokens have to follow are the total supply, balance of, transfer, transferFrom, approve, and allowance. Unfortunately, Ether itself does not comply with the ERC-20 standard. Wrapped Ethereum was developed to increase interoperability between blockchains and make Ether usable in decentralized applications (dApps).

How Does Wrapped Ethereum Work?

Wrapped tokens require custodians to hold the collateral.For instance, if you want to wrap Ethereum, a custodian will hold your Ether and give you Wrapped Ethereum in return. Custodians can be merchants, multi-signature wallets, or simply a smart contract. You send your collateral to the custodian and a wrapped version of your coin is minted. For instance, with Wrapped Ethereum, you could simply go to a DEX like Uniswap and swap your Ether for Wrapped Ethereum. The original Ether is converted to Wrapped Ethereum, but the value stays the same, similar to how dollar-pegged stablecoins work.

On the Ethereum blockchain, Wrapped Ethereum is needed to swap between tokens on decentralized applications. For instance, some decentralized applications cannot work with Ether as collateral but only with WETH. While Ether is needed to pay for gas, WETH is an ERC20-token that can be exchanged for other ERC-20 tokens on DeFi applications. Other blockchains may have their version of WETH, thereby creating a mirror image of Ether on their blockchain.

Reference: https://coinmarketcap.com/alexandria/article/what-is-wrapped-ethereum-weth

Comments