In a longstanding class-action lawsuit, plaintiffs have filed an amended complaint against Tether and Bitfinex, accusing them of manipulating cryptocurrency prices through a deceptive scheme involving USDT, Tether’s dollar-backed stablecoin. The complaint was filed in the Southern District of New York.

The plaintiffs allege that Tether and Bitfinex “executed a sophisticated scheme to fraudulently inflate the price” of cryptocurrencies, including Bitcoin, through “massive, carefully timed purchases […] to signal to the market that there was enormous demand and thus cause the price of those commodities to spike.”

The companies allegedly financed these purchases with billions of dollars in USDT, which — contrary to Tether’s assurances — was not backed one-to-one by US dollars. The plaintiffs claim that by doing so, Tether and Bitfinex violated both the Commodities Exchange Act (CEA) and the Sherman Antitrust Act.

The complaint states, “In reality, Tether issued billions of USDT to itself with no US dollar backing — simply creating the USDT out of thin air,” and alleges that this deception “ultimately resulted in billions of dollars of damage to innocent crypto commodity purchasers.”

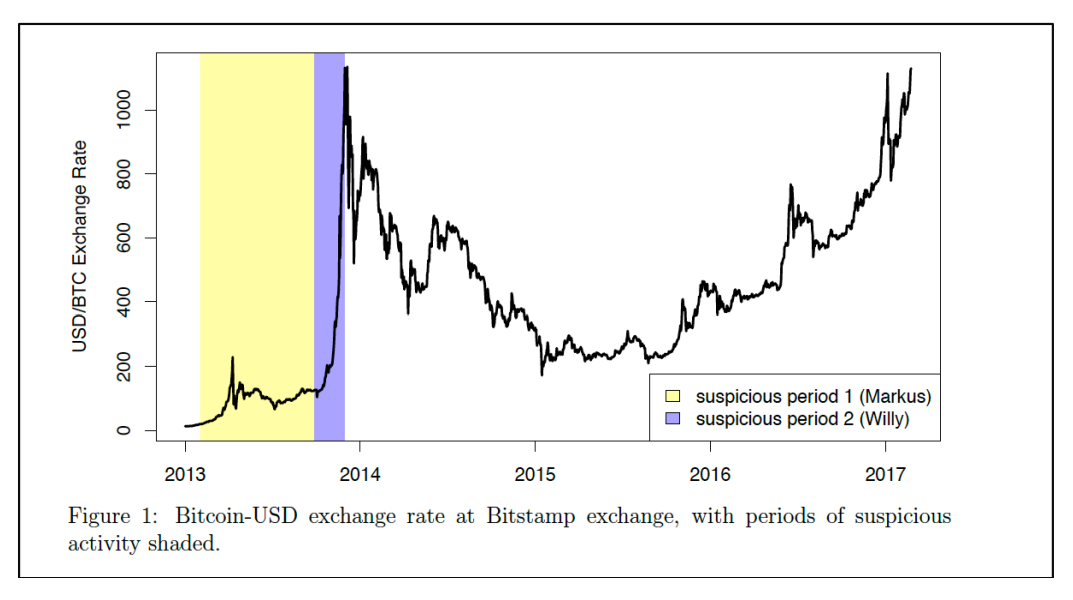

An exhibit from the amended filing highlighting alleged suspicious trading activity on the Bitstamp exchange. Source: CourtListener.com

This is the third complaint filed in this case, which began in 2019 and has faced multiple delays, including the removal of the plaintiffs’ original legal counsel in 2022. Tether and Bitfinex opposed the plaintiffs’ request to amend the complaint in 2023, calling it a last-ditch effort to revive a failing case.

“The reason for this dramatic change of course is clear: two years of fact discovery — including more than a million pages of document discovery and numerous […] depositions — have not revealed a single shred of evidence supporting the market manipulation scheme alleged in the [Complaint],” the defendants argued.

Plaintiffs maintain that “[e]xpert analysis shows that Bitfinex and Tether issued unbacked USDT and used that debased USDT to buy large amounts of crypto commodities.”

Source: Cointelegraph

Comments