Blockchain gaming, decentralized finance, and layer-2 platforms lagged behind newly emerging sectors and the current memecoin frenzy.

The most profitable sectors of the cryptocurrency industry in the first half of 2024 have been revealed, with memecoins and newly emerging sectors scooping up the lion’s share of profits.

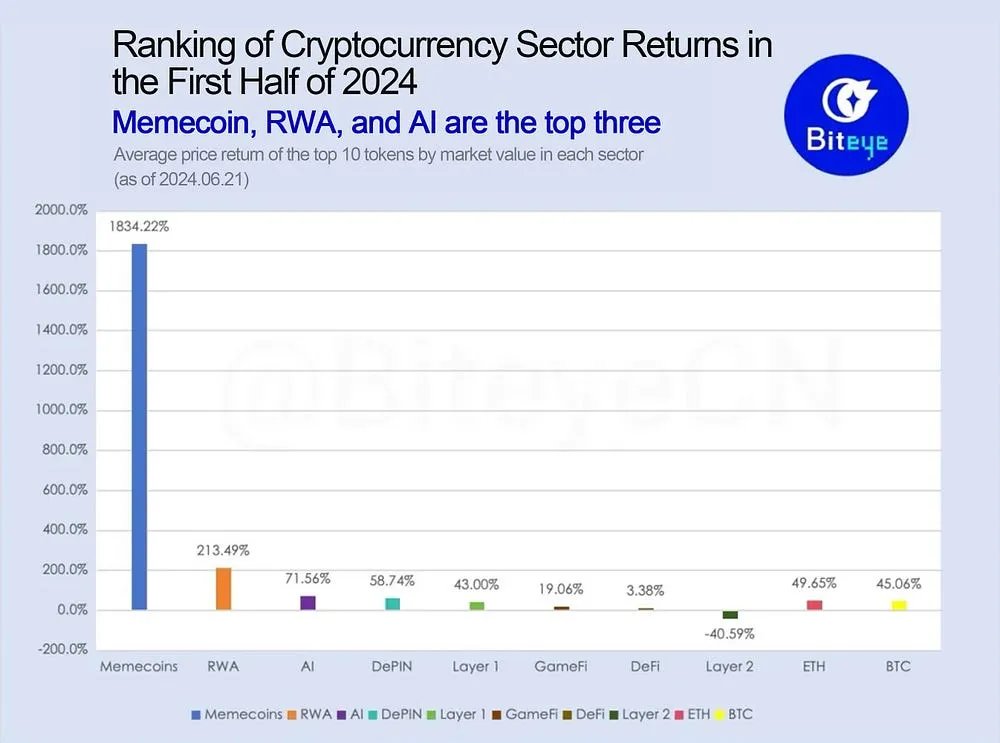

According to data from BitEye, CoinGecko, and Wu Blockchain, memecoins led the competition by recording a staggering 1,834% return since the start of 2024.

In second place was the real-world asset tokenization sector, which returned 214% to investors. Artificial intelligence blockchain projects returned a healthy 72%, while decentralized physical infrastructure networks (DePIN) saw returns of 59%.

Digital asset staples Bitcoin (BTC) and Ether (ETH) continued to perform well, with ETH showcasing year-to-date gains of 50% and Bitcoin returning roughly 45%.

Additionally, layer-1 platforms returned an average of 43%, while sectors like gaming and decentralized finance lagged the competition but still managed to record modest returns at 19% and 3%, respectively. However, the layer-2 sector experienced a notable decline, with total losses averaging roughly 41%.

Profitability breakdown by sector. Sources: BitEye, Wu Blockchain

Memecoin Mania

The meteoric rise of memecoins can partly be attributed to the Solana network. In May, 541,000 new token projects were minted on the Solana blockchain alone. Celebrities and online influencers like Andrew Tate, rapper Lil Pump, and Iggy Azalea flocked to the network to launch their memecoins. Many of these projects have been accused of insider trading activity and, in some cases, pump-and-dump schemes.

Solana’s architecture and focus on user-friendly features that simplify token and smart contract deployment have earned the network a reputation of being the MacOS of blockchain, a title bestowed upon Solana by Pantera Capital.

Real-World Asset Tokenization

No industry analysis can be complete without addressing the burgeoning real-world asset tokenization sector, which has become a favorite topic of institutional investors and banks.

Widely seen as the next frontier for digital assets, real-world asset tokenization could eventually encompass $874 trillion in wealth as the world’s investment funds, stocks, bonds, mutual funds, and even real estate migrate onchain.

Projects like Chainlink continue to make strides toward bringing the world’s assets to the blockchain, with new partnerships prioritizing the digitization of wealth through distributed ledger technology.

Source: Cointelegraph

Comments