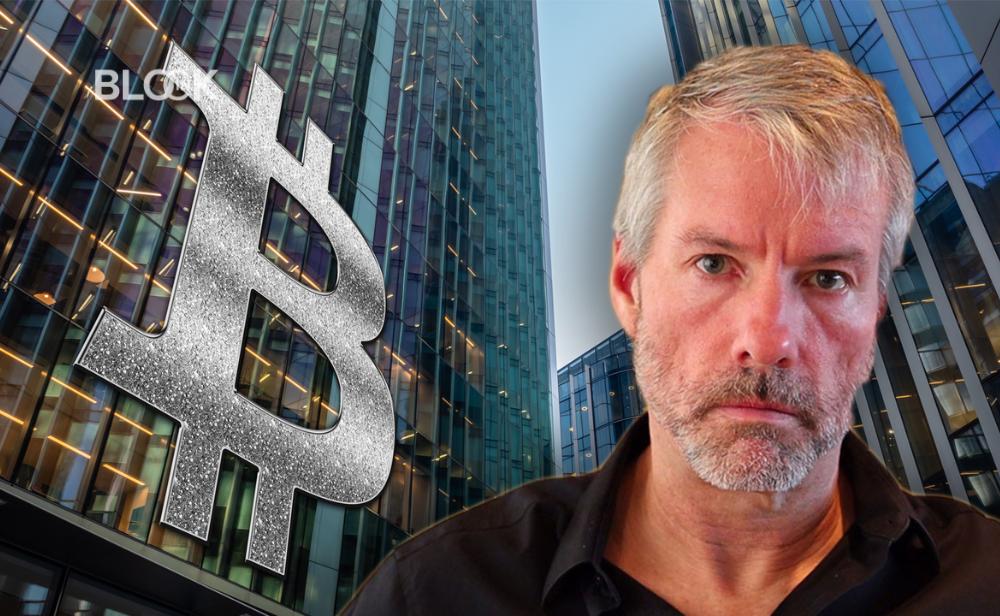

MicroStrategy’s executive chairman Michael Saylor reportedly disclosed details of a 301 BTC acquisition for roughly $6 million – a possession of 0.62% of all the Bitcoin (BTC) that will ever be mined.

Specifically, In sum, the firm is reportedly among the most top-tier holders of the asset throughout the globe, owning 130,000 BTC. Apparently, Saylor likes round numbers, buying 301 BTC to reach the 130,000 milestone.

Because of plummeting price action, the firm’s investment experienced a noteworthy drop in U.S. dollar terms. MicroStrategy’s entry price is approximately $30,639 per BTC, and the Securities and Exchange Commission filing states that the company has completed the acquisition of 130,000 BTC at an aggregate purchase price of around $3.98 billion.

Should MicroStrategy begun its accumulation at today’s prices, it would have spent $2.48 billion on 130,000 BTC. Saylor is currently at a paper loss of over a billion dollars.

Per the SEC filing, the company reportedly used “excess cash” to finalize the payment. Saylor recently departured from his role as CEO of the firm to double down on the acqusition of additional Bitcoin, while Washington, DC has taken aim at the billionaire in a tax evasion lawsuit.

Bitcoin advocates wasted no time to commend Saylor’s purchase. Referred to as the “Chad” or “Gigachad,” Saylor’s conviction and commitment to buying Bitcoin despite the investment being underwater has garnered both a devout following and numerous critics.

Additional major wallet addresses include that of crypto exchange Bitfinex, which holds 170,000 BTC, and a Binance reserve wallet that holds 125,000 BTC.

Binance is the world’s largest crypto exchange, with possession of over numerous wallets holding six figures of Bitcoin. Regarding individuals, Saylor has stated that he holds Bitcoin, and FTX CEO Sam Bankman-Fried and Binance CEO Changpeng Zhao are also “hodlers” — a meme that became popular jargon for holding crypto.

Comments