Five members of the Georgia House of Representative’s collaborative rolled out legislation aimed at providing exemption to crypto miners in the region, from paying sales and use tax.

Specifically, Georgia Representatives Don Parsons, Todd Jones, Katie Dempsey, Heath Clark, and Kasey Carpenter reportedly put in the work to roll out HB 1342 – legislation with no official name yet.

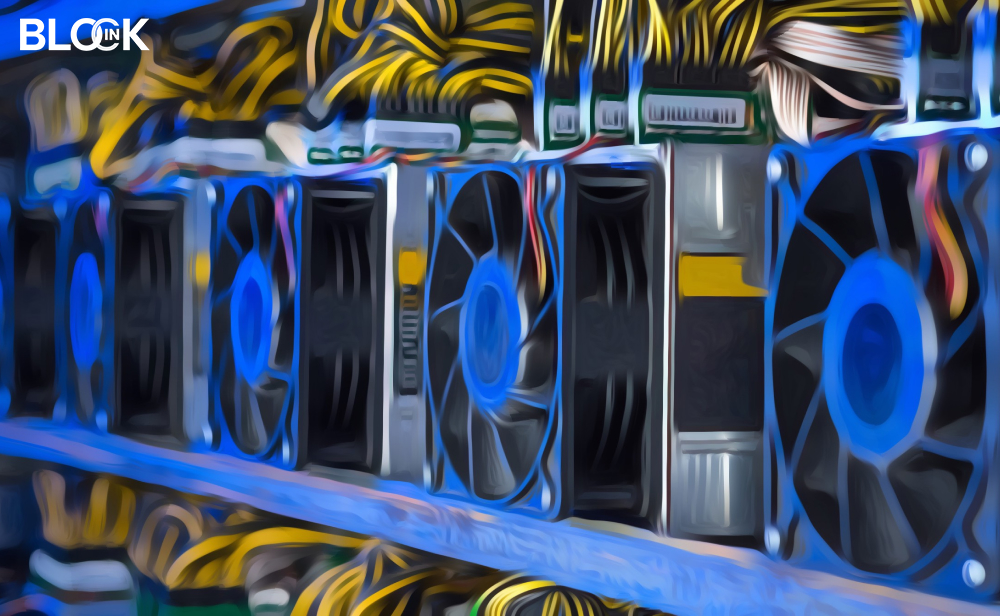

The bill reportedly aims to make adjustments to the state tax code “to exempt the sale or use of electricity used in the commercial mining of digital assets”, with a likelihood of being applicable exclusively to commercial miners functioning in a center of a minimum of 75,000 square feet – around 6,968 square meters.

The proposed regulation is reportedly the most recent in the series of state-level methods, with a primary target of encouraging crypto miners to set up shop.

In January, Illinois lawmakers reportedly rolled out legislation looking to extend tax incentives for data facilities doing business in crypto mining. Kentucky came up with the same type of regulation in March last year.

Electricity costs are reportedly still viewed as a significant reason for crypto entities aiming to carry out the expansion of their operations in America and beyond.

Canadian Bitcoin (BTC) mining firm Bitfarms reportedly disclosed in November details of the plans down its pipeline to develop the first data facility in Washington State, with reasons related to its “cost-effective electricity” and production rates.

Texas was reportedly also chosen as the safe haven by a variety of establishments evading the crackdown of mining in China, potentially because of the state’s deregulated power grid and renewable energy sources.

Comments