Celebrities who have recently promoted memecoins on social media platforms like X are at a high risk of catching the attention of the SEC and facing potential class-action lawsuits, according to legal experts.

Public figures in the U.S., such as Caitlyn Jenner, Iggy Azalea (real name Amethyst Kelly), Jason Derulo (real name Jason Desrouleaux), and several others, have launched and promoted crypto tokens using their likenesses since late May.

“Nothing gets the SEC to act faster than shilling a memecoin,” said David Chung, founding director of Creo Legal, to Cointelegraph. He highlighted that Jenner, who was the first to gain attention for her token, is “painting a target on her back.”

“The SEC could potentially go after her for selling unregistered securities without an appropriate license,” Chung added.

Liam Hennessy, a partner at law firm Clyde & Co, echoed these sentiments, noting that celebrities faced legal issues during the last bull run for promoting cryptocurrencies without disclosing their commissions. For instance, Kim Kardashian paid over $1.26 million in fines for endorsing EthereumMax (EMAX).

Jenner did not respond to a request for comment sent via her website.

Hennessy pointed out that the SEC has claimed “nearly all crypto tokens are securities,” and if these celebrity tokens fall under this definition, the issuers would need to register with the SEC. Failure to do so could result in significant penalties and fines for unlicensed activities. While celebrities might not be the token issuers, distancing themselves from the primary legal concerns may not shield them entirely.

In October 2023, SEC Chair Gary Gensler appeared in a video warning about celebrity-endorsed crypto tokens. Source: YouTube

The tokens were launched on the Solana-based memecoin creation platform pump.fun. Jenner and Derulo have stated that Sahil Arora, an alleged serial scammer and celebrity memecoin promoter, assisted in creating their respective tokens, Caitlyn Jenner (JENNER) and Jason Derulo (JASON).

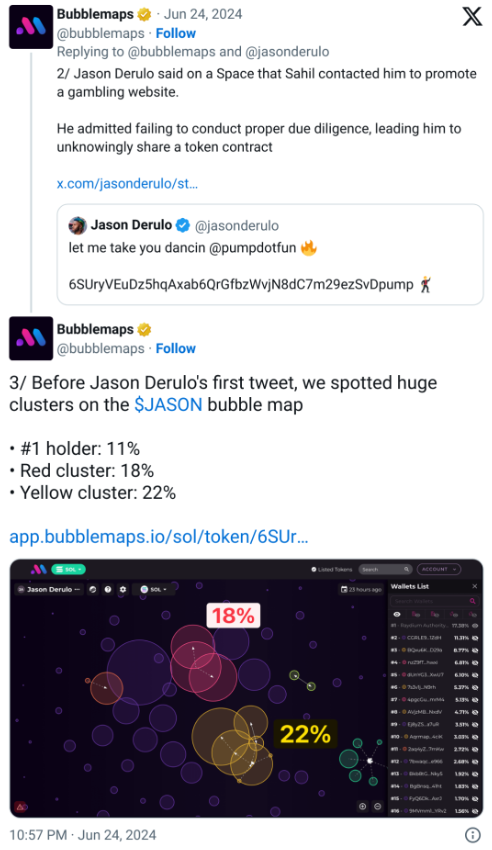

Crypto analytics firm Bubblemaps has reported insider trading activity at the launch of these tokens, with some wallets profiting millions of dollars.

Jenner and Derulo have publicly accused Arora of scamming them, but Arora claimed in June that Derulo’s accusations were “all orchestrated.”

A Telegram account controlled by Derulo or a member of his team did not respond to inquiries.

Chung emphasized that the release of a cryptocurrency token is a “key liability event” for its creators and that distancing oneself from such events is prudent. However, if it can be shown that a celebrity coordinated with Arora and staged a public fallout, it would not provide legal protection. If the tokens are not compliant with regulations, Arora would remain responsible for the token sale even if he is no longer involved with the project. Arora did not respond to a message sent via Instagram.

The value of JENNER, JASON, and MOTHER tokens has significantly decreased from their peak prices. MOTHER, the largest by market cap, is down 84.5% from its June 6 high of $0.23, while JENNER and JASON have dropped by 55.5% and nearly 78%, respectively, from their peaks in early and late June, according to CoinGecko.

MOTHER’s nearly $36 million market cap is down from its peak of nearly $149 million. Source: CoinGecko

A Telegram account controlled by Azalea did not respond to inquiries, and her manager did not respond to a message sent on LinkedIn. In a July 9 X post, Azalea acknowledged that Cointelegraph had contacted her manager and stated that she had been advised by a team of seven lawyers from the beginning of the $MOTHER token creation. She insisted, “We have never put a toe into murky water, and we are not a security.”

Beyond the SEC, celebrities must also be wary of potential class-action lawsuits from investors who incur losses. “If enough people lose their money, then we could easily see a class action,” Chung added. “The vast majority of memecoin projects end up going to zero, so I’m not expecting anything different here.”

Hennessy advised that dealing with securities involves numerous requirements, making it safer for celebrities to stick to their primary careers.

The SEC did not respond to a request for comment by the time of publication.

Source: Cointelegraph

Comments