AI and Bitcoin: A Powerful Combination

Bitcoin will become the preferred asset for securing wealth generated by AI over the next decade, according to Bitcoin advocate and venture capitalist Anthony Pompliano.

The Role of Bitcoin in an Automated World

“We are entering an automated world where AI will create enormous amounts of wealth, and Bitcoin will protect that wealth,” said Pompliano, founder of Pomp Investments, in an interview with CNBC on June 24.

Complementary Technologies

Pompliano rejected the notion that AI has overshadowed Bitcoin and the broader cryptocurrency industry as the latest tech trend. Instead, he believes the two technologies will work together over the next ten years.

“There’s potential for GDP to increase due to AI-driven productivity, with Bitcoin safeguarding much of this wealth,” Pompliano noted. “Those focused on short-term fluctuations are missing the significant long-term potential.”

“When considering the integration of these technologies, the question arises: what currency will these machines use?”

Market Sentiment and Bitcoin’s Recent Performance

On June 23, Bitcoin hit a seven-week low of $59,086. Negative sentiment stemmed from Mt. Gox preparing to sell $8.5 billion worth of Bitcoin to its creditors, spot Bitcoin exchange-traded fund outflows exceeding $1 billion over ten days, and a substantial selloff by Bitcoin miners.

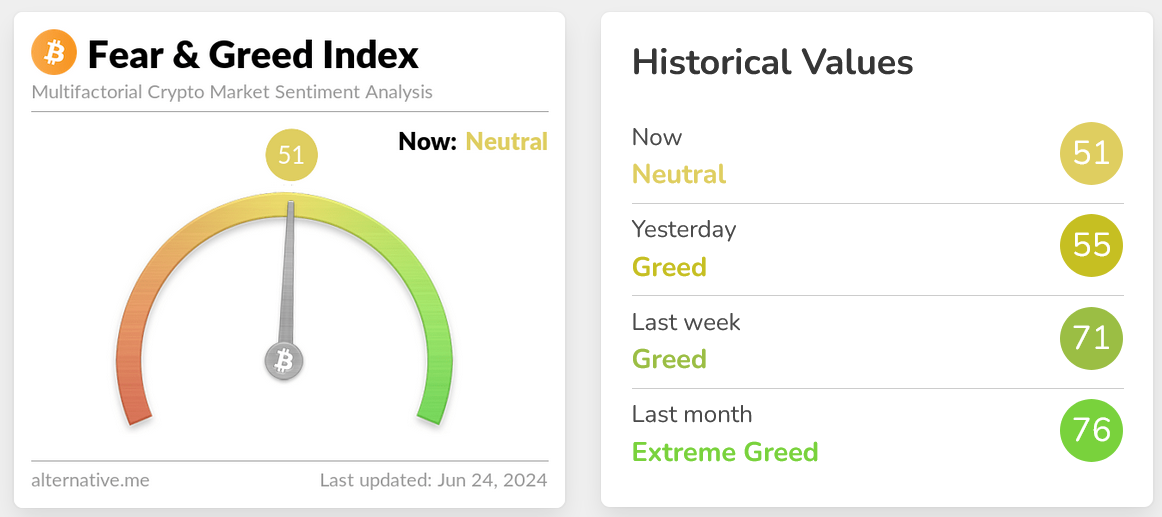

As a result, the Crypto Fear and Greed Index placed Bitcoin and the cryptocurrency market sentiment in the “Neutral” zone with a score of 51 out of 100. A week earlier, the index was in the “Greed” zone with a score of 71 out of 100.

Pompliano’s Perspective on Price Fluctuations

Despite the current 15% price decline, Pompliano remains unfazed. He highlighted that price pullbacks of 30% or more are common in bull markets.

“In public markets, the saying goes, ‘invest until May and go away,’ which often results in sideways trading in the second and third quarters, especially in halving years,” Pompliano explained.

He anticipates a price rally in the last quarter of 2024 or early 2025, aligning with historical trends during halving years.

Source: Cointelegraph

Comments