According to Crunchbase, large funding rounds remain infrequent in the Web3 sector.

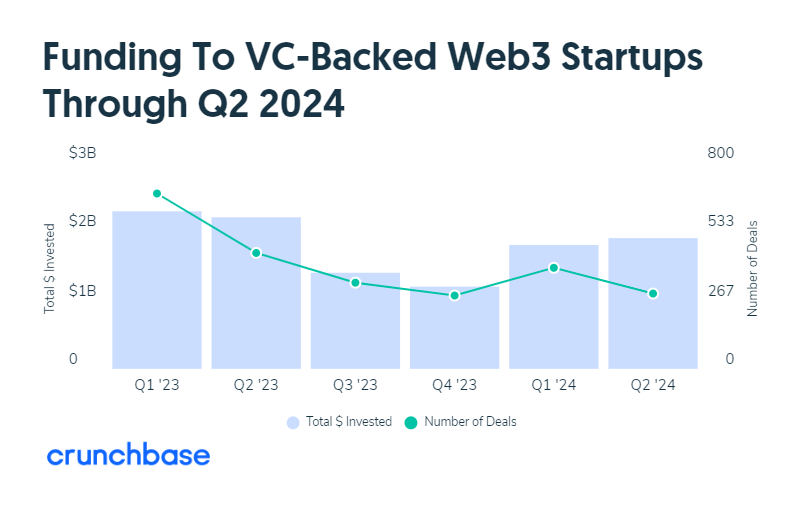

Web3 startups have seen venture funding stabilize after a significant decline throughout 2023. In the second quarter of 2024, crypto ventures secured around $2 billion in financing, as reported by Crunchbase. This figure represents a modest increase from the $1.8 billion raised in the previous quarter, marking a reversal from the downward trend that saw quarterly venture funding plummet from $2.3 billion in Q1 2023 to $1.4 billion in Q4 2023.

The decline in total deal volume has paralleled the reduction in funding. Deal volume fell sharply from a peak of 681 deals in Q1 2023 to about 284 in Q4 2023. Despite the recent rebound in funding amounts, deal volume remains low, with only 291 financing rounds closing in Q2 2024, according to Crunchbase data.

Q2 2024 saw a modest recovery in total deal value, but the number of deals still lags past quarters. Source: Crunchbase

Web3 venture deals are not only scarce but also more conservatively sized. Only seven rounds exceeded $50 million in Q2 2024, as noted by Crunchbase.

A significant portion of the apparent recovery in the past quarter can be attributed to a single deal: Monad Labs, based in New York, raised $225 million in a funding round led by Paradigm. Monad is a new layer-1 blockchain network poised to compete with platforms like Solana.

Other notable Q2 deals include:

- Farcaster’s $150-million Series A led by Paradigm, valuing the company at $1 billion.

- Berachain’s $100-million round led by BH Digital and Framework Ventures, valuing it at $1.5 billion.

- Auradine’s $80-million round from investors, including Mayfield Fund and Celesta Capital.

The sluggish deal flow is partly due to venture fund investors, known as limited partners (LPs), awaiting payouts from previous investments before committing to new ones. Venture capital firms (VCs) are also running low on available funds, according to Regan Bozman, co-founder of Lattice Capital.

“There is a market dislocation starting to happen where many crypto VC funds are on the final 25% of deployment and so will need more money in the next six months, but LPs want distributions first,” Bozman said in a post on the X platform. “But VCs need the market to come back before they can make distributions.”

Comments