Approval and Launch

The launch comes a day after the United States Securities and Exchange Commission (SEC) granted final approval for spot Ether ETFs, allowing multiple issuers to start trading their products. Bloomberg analyst James Seyffart noted in a July 22 post that while the Grayscale Ethereum Trust (ETHE) had not yet received official effective documents from the SEC, they were expected to arrive on the morning trading commenced.

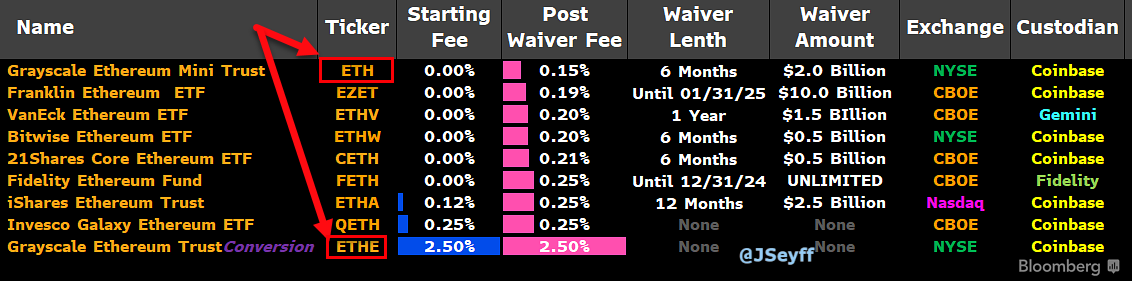

ETHE is currently the world’s largest Ether-based exchange-traded product, holding $9.19 billion worth of ETH. Investors in ETHE will incur a 2.5% management fee.

Grayscale’s second product, the Grayscale Ethereum Mini Trust, has waived fees for the first six months or until it reaches $2 billion in net assets under management. After reaching either threshold, a 0.15% fee will be applied, making it the most cost-effective spot Ether ETF in the US.

Investor Benefits

“ETH and ETHE will enable investors to leverage Ethereum’s potential to create markets, transform financial systems, utilize decentralized finance (DeFi), and drive innovation, all through the trusted ETP wrapper — without the need to buy, store, or manage Ethereum directly,” stated Grayscale’s managing director John Hoffman in a statement to Cointelegraph.

Other Approved ETFs

In addition to Grayscale, Ether ETFs from BlackRock, Fidelity, 21Shares, Bitwise, Franklin Templeton, VanEck, and Invesco Galaxy were also approved to begin trading on Tuesday, July 23.

Details of the US listed spot Ether ETFs. Source: James Seyffart

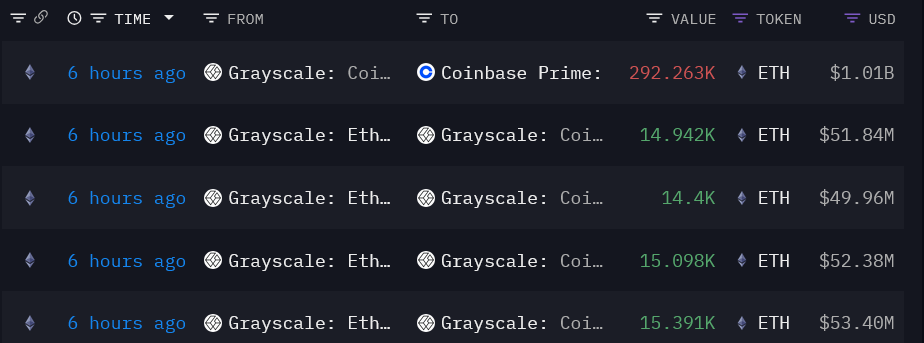

Large Transfer to Coinbase

On July 22, Grayscale transferred over $1 billion worth of ETH to Coinbase in preparation for the ETF launches. This transfer involved 292,263 Ether, valued at just over $1.01 billion, matching the amount Grayscale indicated it would move from ETHE to its Ethereum Mini Trust in a July 18 filing. According to Seyffart, this move should help mitigate some potential outflows from Grayscale.

Grayscale’s ETH transfers to Coinbase Custody on July 22. Source: Arkham Intelligence

Current ETHE holders will receive the new Ether-backed product at a 1:1 ratio without triggering a capital gains tax event.

Market Expectations

Seyffart and fellow Bloomberg ETF analyst Eric Balchunas anticipate that the spot Ether ETFs will capture between 10% to 20% of the inflows seen by spot Bitcoin ETFs since their launch over six months ago. However, Matt Hougan, Bitwise’s chief investment officer, is optimistic that the spot Ether ETFs might have a more substantial impact on Ether’s price compared to the effect spot Bitcoin ETFs have had on Bitcoin. Hougan predicts that Ether’s price could surpass its current all-time high, potentially exceeding $5,000 by the end of 2024.

Source: Cointelegraph

Comments