According to a new report by Kaiko, Ether could potentially outperform Bitcoin following the launch of the highly anticipated Ethereum exchange-traded funds (ETFs) in the United States.

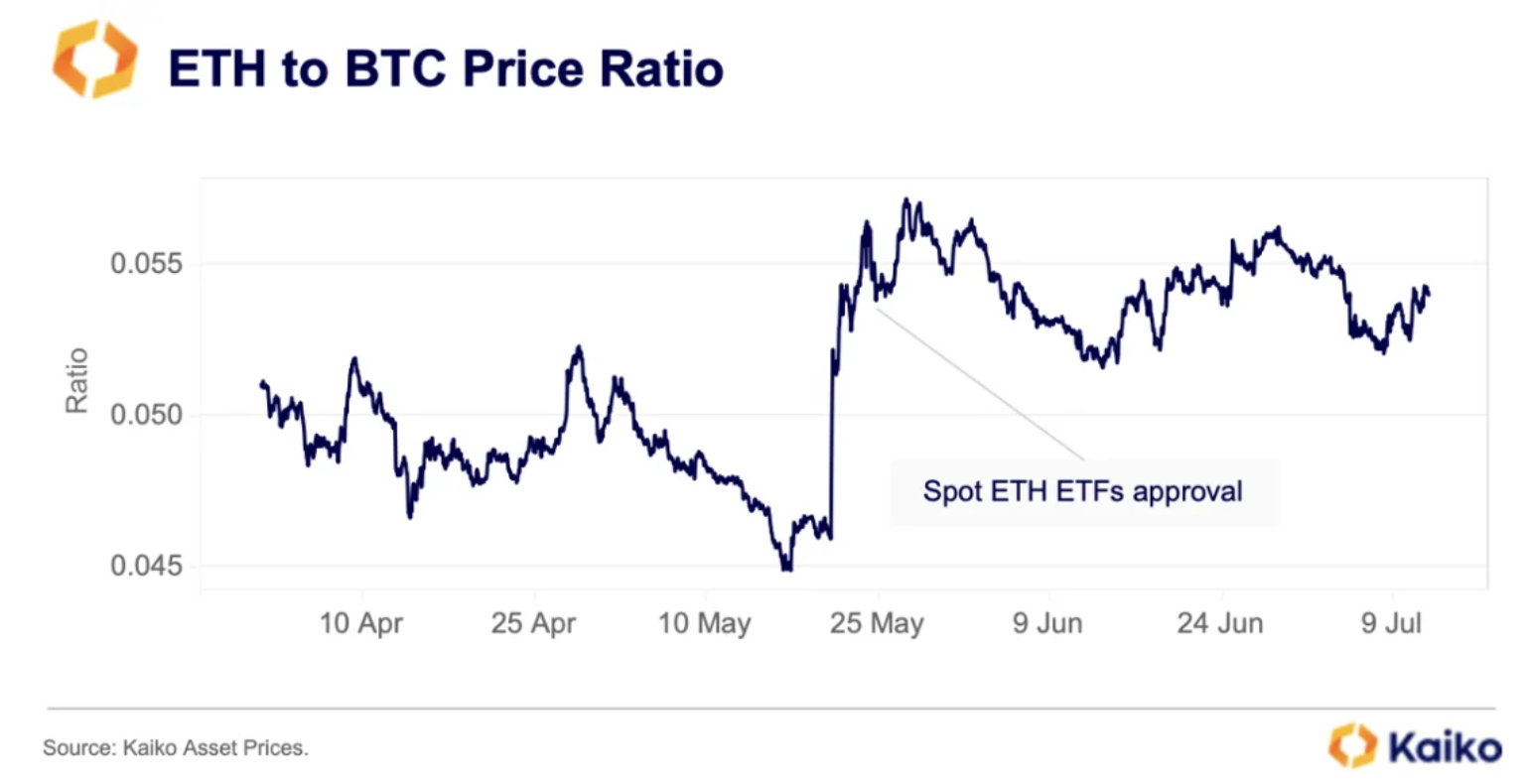

The report emphasized the Ether (ETH) to Bitcoin (BTC) Price Ratio, a metric that indicates how much BTC is needed to purchase one ETH. A higher ratio means a higher price of Ether relative to Bitcoin. Currently, the ratio stands at 0.05, up from 0.045 before the Securities and Exchange Commission (SEC) approved the spot Ether ETFs.

ETH to BTC Price Ratio. Source: Kaiko

Market Depth and Ethereum Exchange Reserves

Kaiko’s report also pointed to Ether’s 1% market depth as a potential catalyst for a future ETH bull run. Market depth measures market liquidity: lower liquidity leads to higher volatility, while higher liquidity stabilizes prices against large orders. The Ethereum Exchange Reserve, which tracks the amount of Ether available for purchase on exchanges, is at multi-year lows, suggesting a possible supply shock driven by institutional demand to fill their Ethereum ETFs, potentially driving prices significantly higher.

Imminent Launch of Ethereum ETFs

All eyes are on the launch of the spot Ethereum ETFs, which could happen sooner than expected. Senior Bloomberg ETF analyst Eric Balchunas forecasts a July launch window, with the SEC having asked applicants to submit amended S-1 forms by July 16, ahead of a potential July 23 launch date.

Institutional investor Tom Dunleavy recently told Cointelegraph that he expects the Ethereum ETFs to see $10 billion in inflows at a rate of roughly $1 billion per month.

Regulatory Controversy

Ether’s status as a commodity or security has been a contentious issue in regulatory circles. In June, the SEC dropped its investigation into the smart contract protocol, presumably to avoid embarrassment, according to Consensys attorney Laura Brookover. More recently, Rostin Behnam, chairman of the Commodities Futures Trading Commission (CFTC), argued that ETH is a commodity and falls within his agency’s purview.

Source: Cointelegraph

Comments