The Chicago Board Options Exchange (Cboe) has submitted a new proposal to the U.S. Securities and Exchange Commission (SEC) for listing Solana ETFs from VanEck and 21Shares. Experts predict that the Solana ETFs could launch by mid-March 2025.

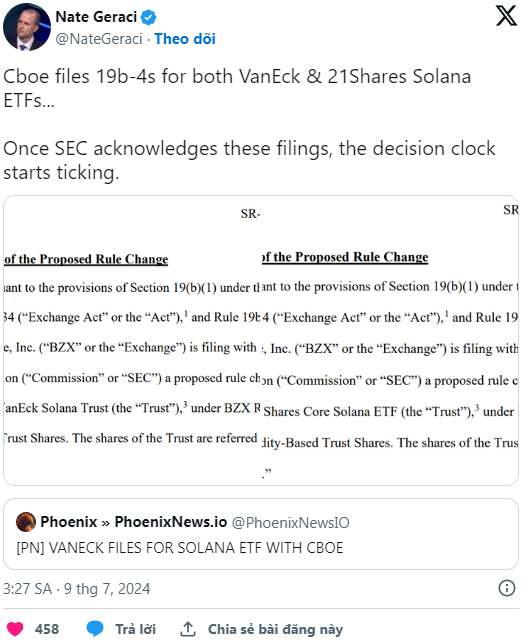

Nate Geraci, president of the ETF Store, shared on X (formerly Twitter) on July 8 that Cboe officially filed the 19b-4 form with the SEC, seeking approval to list the Solana ETFs from VanEck and 21Shares. This follows the submission of the S-1 filing in June 2024.

The 19b-4 form is essential for notifying the SEC of changes to the ETF proposal and is a crucial document for moving towards approval.

This is the first positive step from Cboe after its representative expressed concerns that the Solana ETFs might struggle without a futures market.

Rob Marrocco, Global Head of ETP Listings at Cboe Global Markets, stated: “With the successful listing of the first Bitcoin spot ETFs in the U.S. on our exchange and obtaining SEC approval for future Ethereum spot ETFs, we are now addressing the growing interest from investors in Solana—the third most traded token after Bitcoin and Ethereum.”

Previously, Cboe listed 6 out of the 10 existing Bitcoin spot ETFs, including products from Fidelity, Ark/21Shares, and VanEck. It is also set to list 5 Ethereum spot ETFs if they receive SEC approval.

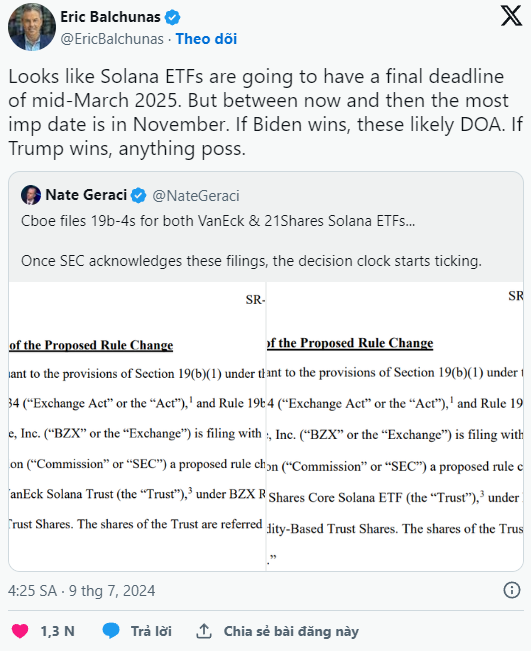

Once the filing is received, the SEC has 240 days to decide whether to approve the necessary regulatory changes for Cboe to list the Solana ETFs from VanEck and 21Shares, with a deadline set for mid-March 2025.

Bloomberg ETF analyst Eric Balchunas noted that the likelihood of SEC approval for the Solana ETFs heavily depends on the outcome of the upcoming presidential election in November. He suggested that a Joe Biden victory could hinder the approval, while a Donald Trump win might open the door to possibilities.

The VanEck and 21Shares Solana ETFs are expected to boost the value of Solana due to the diverse applications of the SOL token. Market maker GSR is optimistic about SOL’s price potential, predicting it could increase nearly ninefold, similar to past trends with BTC and the anticipated rise of ETH.

1H chart of the SOL/USDT pair on Binance at 03:15 PM on July 9, 2024

SOL’s price has risen by 5.18% in the past 24 hours, reacting positively to the news, and is currently trading around $142.

Source: Coin68

Comments