Bitcoin whales have made significant moves during the recent crypto market slump, amassing 71,000 BTC — valued at approximately $4.3 billion at current prices. This marks the highest accumulation over a 30-day period since April 2023, a time shortly after several local banks in the United States collapsed.

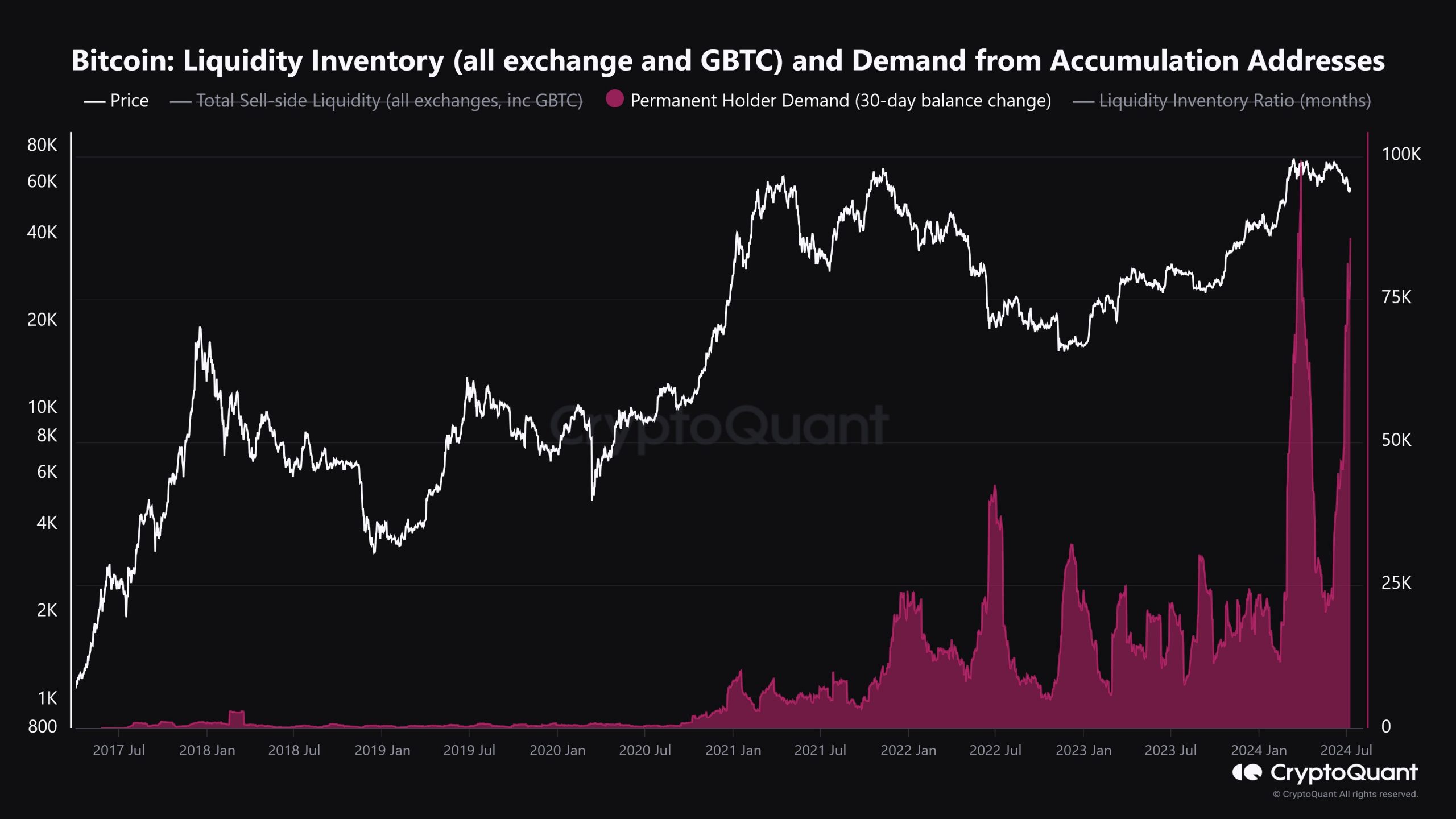

A chart from cryptocurrency analytics firm IntoTheBlock shows that much of this Bitcoin was acquired when the price retraced to $54,200 on July 5. CryptoQuant also highlights that Bitcoin whales are stacking BTC at the fastest rate (on a 30-day moving average) since April 2023. CryptoQuant analyst Minkyu Woo suggested in a separate X post that this trend indicates Bitcoin may be nearing its bottom.

Bitcoin demand from accumulation addresses. Source: CryptoQuant

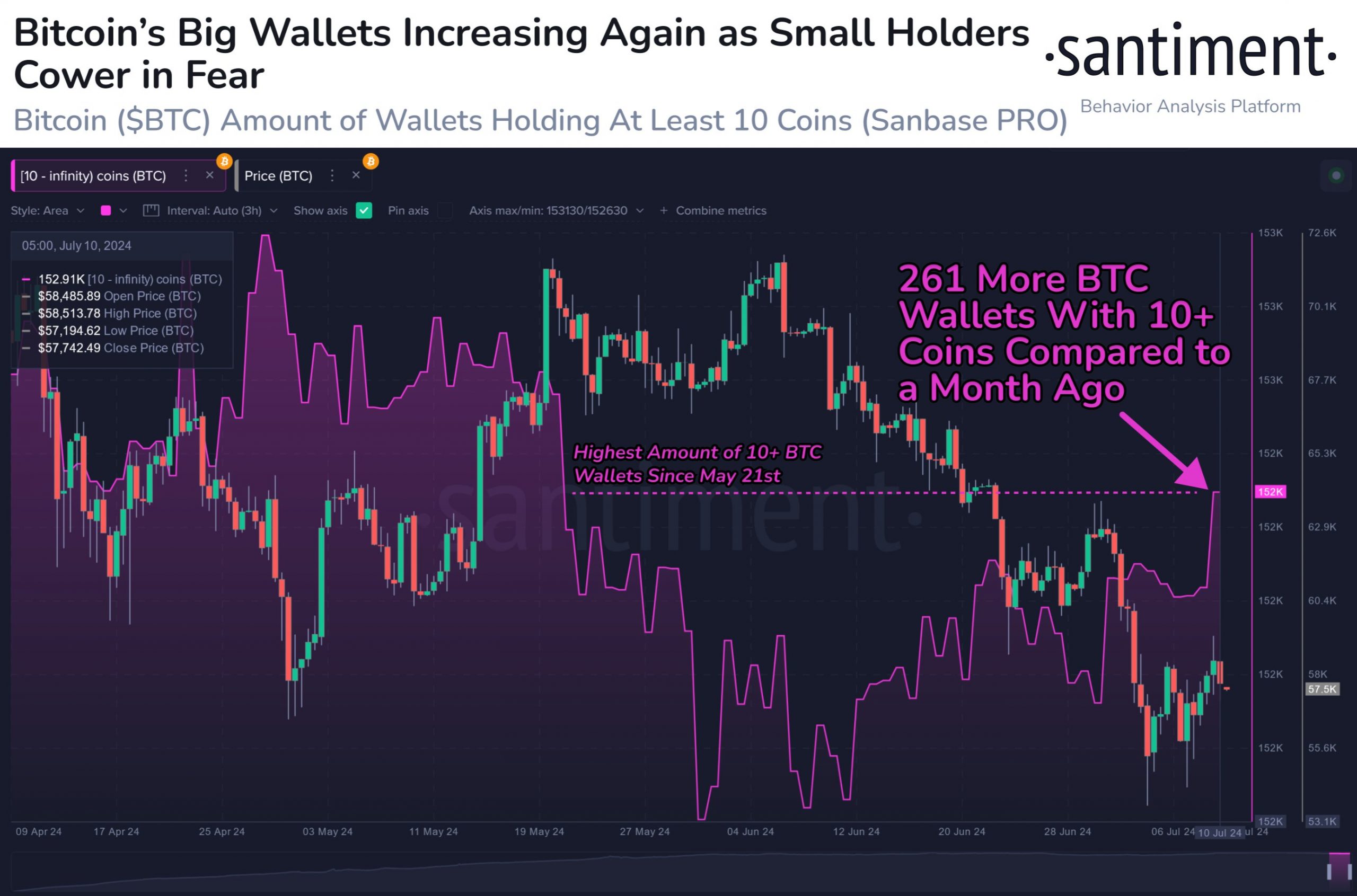

In contrast, smaller traders have been offloading their holdings during the current dip, as noted by cryptocurrency analytics firm Santiment. Santiment observed a net increase of 261 in the number of Bitcoin wallets holding at least 10 BTC during the first 10 days of July, indicating a long-term bullish outlook for some traders.

Number of Bitcoin wallets with at least 10 Bitcoin. Source: Santiment

However, not all Bitcoin whales are simply holding their assets. On July 14, a dormant Bitcoin whale transferred 1,000 BTC — worth nearly $60 million — to two new wallets after a 12-year hiatus, as reported by Whale Alert.

Currently, Bitcoin is trading at $60,850, down 8.1% over the last month. Industry experts attribute the price slump largely to Mt. Gox preparing to offload $8 billion to its creditors and the German government selling nearly 50,000 Bitcoin, valued at $3 billion.

Despite the downturn, Bitcoin showed signs of recovery over the weekend, breaking the $60,000 resistance level and increasing by 6% since the close of trading on Friday. This included a sharp rise immediately after US presidential candidate Donald Trump survived an assassination attempt while speaking at a rally in Butler, Pennsylvania, on July 13.

Source: Cointelegraph

Comments