Sequoia Capital warns that the AI industry must generate around $600 billion in profit to justify current expenditures, highlighting the urgency for advancements in artificial general intelligence (AGI).

The Investment-Profit Disparity

Artificial intelligence companies are under pressure to fulfill their promises of developing AGI — machines capable of human-level reasoning — to balance the significant gap between investments and profits. Currently, there’s no scientific consensus that AGI is achievable.

An Anticipatory Market

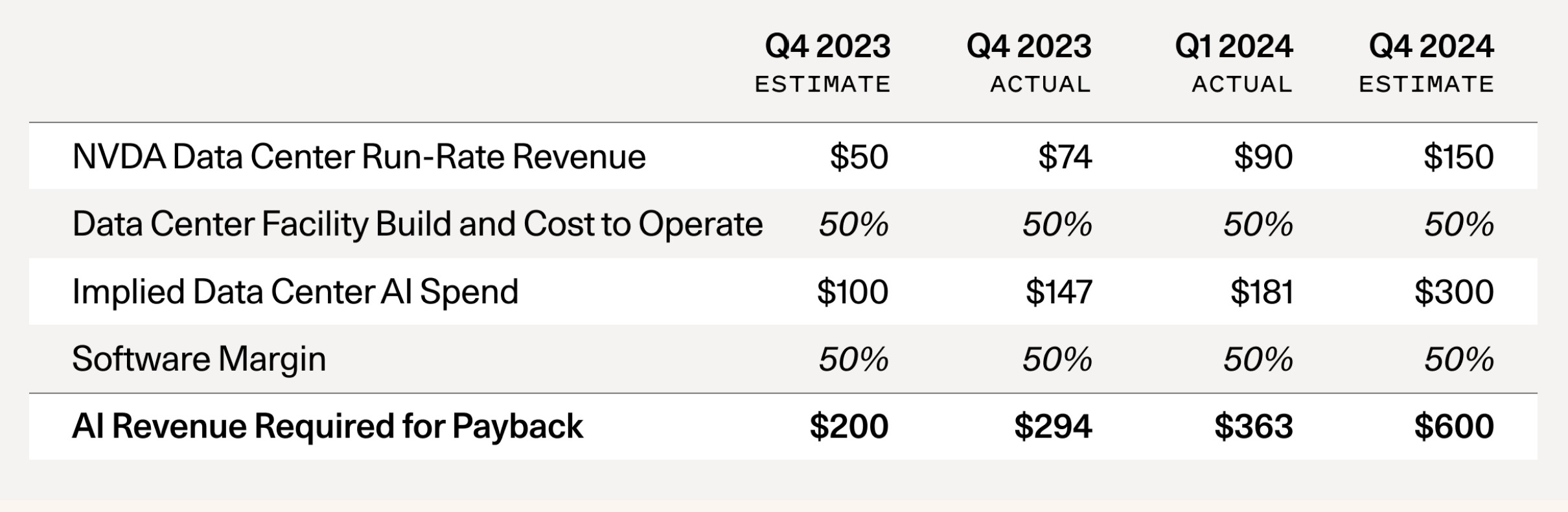

The AI market is primarily driven by anticipation, with few profitable enterprises like OpenAI, which reportedly generates about $3.4 billion in revenue. This starkly contrasts with its closest competitors, creating a significant capital shortfall. Sequoia Capital’s analysis suggests a negative cash flow of approximately $600 billion, primarily based on Nvidia GPU usage estimates. This figure is expected to grow annually, emphasizing the need for substantial revenue generation to validate current spending.

Source: Sequoia Capital

The Product Gap

Despite increased investor and corporate interest driving the AI market to unprecedented heights, including Nvidia’s brief reign as the world’s most valuable company by market cap, analysts question the arrival of sustainable AI products and services. Generative AI has yet to demonstrate a clear value proposition that leads to significant profits. ChatGPT, while notable, isn’t poised to become a mainstream revenue generator overnight.

Given OpenAI’s current profit margins, reaching the $600 billion revenue target could take decades. Generative AI investments continue to rise across venture capital, government, and corporate sectors, but a tangible, profitable use case remains elusive.

AGI or Bust

The AI market might soon face an “AGI or bust” scenario, where the future of companies like OpenAI and Anthropic hinges on their ability to develop human-like reasoning machines. Without AGI, the sector may struggle to justify Nvidia’s valuation near $3 trillion, potentially widening the $600 billion industry shortfall.

Optimistic Outlook

Conversely, achieving AGI could eliminate the point of no return. Nvidia plays a crucial role in this scenario. Sequoia Capital notes that Nvidia’s upcoming Blackwell-based chipset (B100), designed for training generative AI, promises to outperform the current industry standard (H100) by 2.5 times at only 25% higher cost. This 150% increase in power and efficiency could significantly accelerate AGI development, potentially fulfilling the industry’s lofty promises.

In summary, the AI industry faces a critical juncture where the successful development of AGI could secure financial stability, while failure to do so may exacerbate the current investment-profit disparity.

Source: Cointelegraph

Comments