Anduro, a sidechain platform fostered by Bitcoin mining company Marathon Digital, is actively seeking partnerships to develop BTC payment applications, according to a company executive.

Jullian Duran, Marathon’s product lead for side chains, announced at the Bitcoin 2024 conference on July 26 in Nashville, Tennessee, that Anduro is looking to collaborate with blockchain developers to create Bitcoin layer-2 solutions aimed at enhancing cross-border BTC payments.

Duran emphasized that cross-border payments represent “the biggest use case for blockchain, generally speaking, and especially for Bitcoin.” He highlighted that developing payment solutions is a top priority for Anduro.

In emerging markets, sending money overseas typically incurs costs of 8% to 10% of the transaction value, with settlements taking three to four days, according to Duran. In contrast, Bitcoin transfers usually settle in 10 minutes or less, and Bitcoin layer-2 solutions could be even faster, he noted.

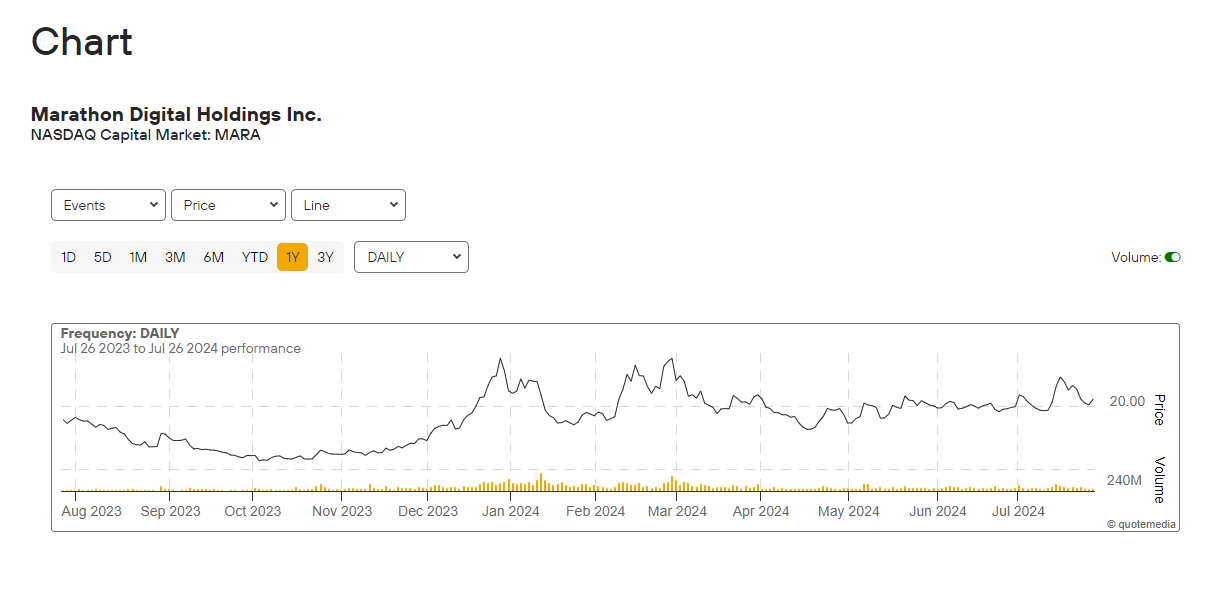

Marathon Digital’s 12-month stock performance. Source: Marathon Digital

Duran stressed the importance of regulatory compliance for any successful payment solution, even though it may be costly. He mentioned that ensuring all necessary licenses are in order is essential, even if it extends the product development timeline from a month to a year.

Despite the high cost of compliance in the United States, Duran encouraged developers not to be discouraged, pointing out that emerging markets offer a more supportive environment for cross-border payment solutions. These regions tend to approve new payment systems more quickly and cheaply due to a greater demand for improved cross-border payment solutions.

Besides payments, Marathon is also focusing on tokenizing real-world assets (RWAs). Duran revealed plans to tokenize whisky barrels in the US and has partnered with an RWA platform to preserve French castles.

Marathon Digital, one of the largest corporate holders of BTC, boasts a treasury of approximately 20,000 coins valued at over $1 billion. The company acquired around $100 million worth of BTC in July alone.

Comments