The current oversupply of artificial intelligence (AI) technology has extended the time needed to recover costs from major AI investments, potentially prompting large corporations to reconsider their investment strategies. The optimistic surge in “Magnificent Seven” tech stocks may be waning due to investor dissatisfaction with the pace of AI advancements.

The term “Magnificent Seven” refers to the top-performing tech stocks, which include Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla.

Waning Hype for the Magnificent Seven

The excitement surrounding the Magnificent Seven stocks may be fading as investors become disappointed with the progress in AI development. Sandeep Rao, a senior researcher at Leverage Shares, explained that AI advancements have not substantially reduced human labor costs, leading to investor disillusionment. According to Rao:

“The anticipated savings on human labor costs in AI-centric firms have not materialized as expected, leaving investors disheartened.”

This disappointment could drive investors to reconsider their portfolios and explore other promising long-term stock options.

Impact of AI Oversupply on Tech Stocks

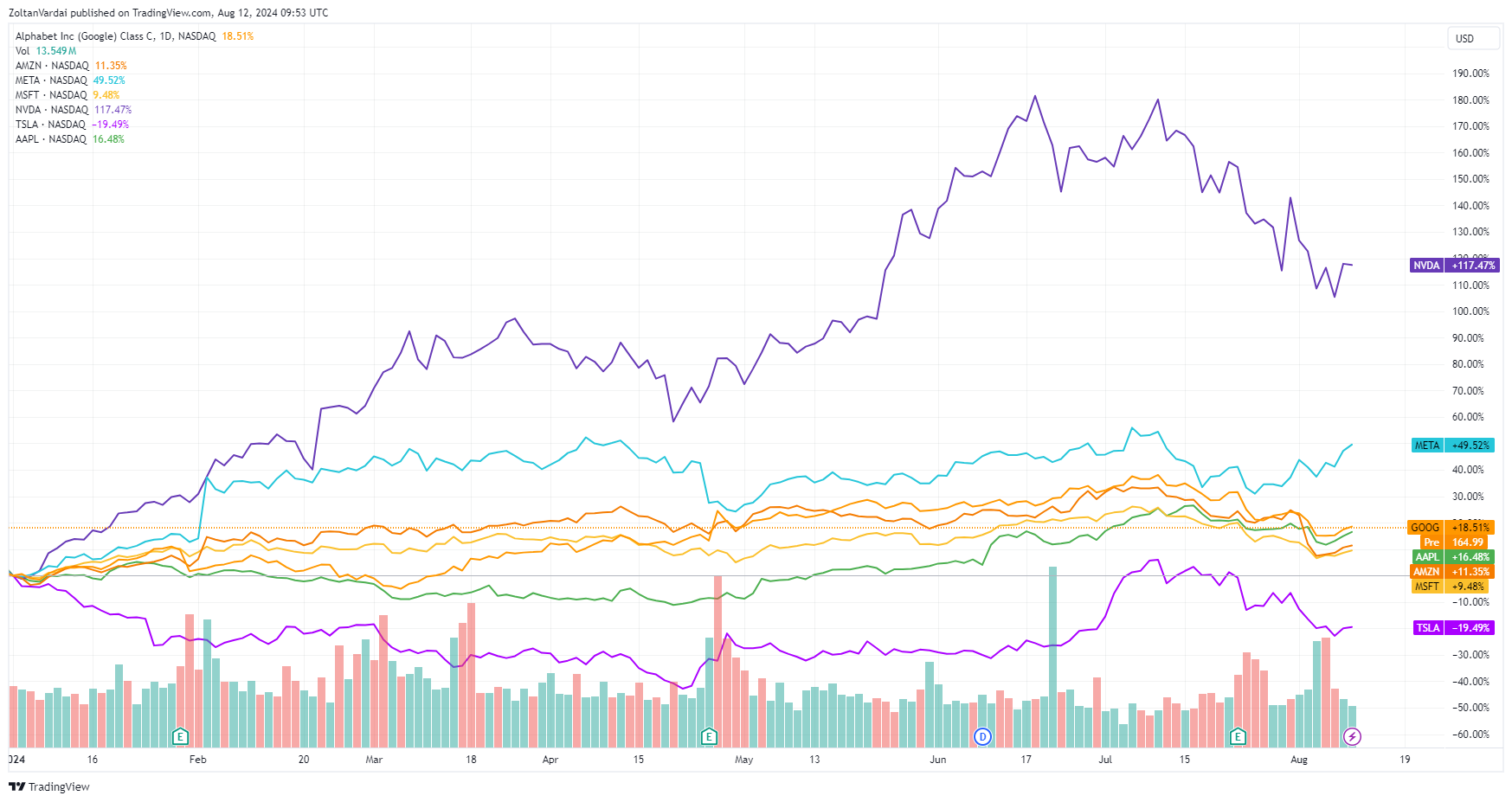

All Magnificent Seven stocks, except Tesla, which saw a year-to-date (YTD) decline of over 19%, remain in positive territory, with Nvidia leading with a 117% increase YTD, as per Nasdaq data. However, large-scale AI spending has resulted in the creation of AI models with capacities far exceeding the current demands of the global internet.

Magnificent Seven stocks, year-to-date chart. Source: TradingView

Rao noted that this oversupply could significantly prolong the cost recovery period for these AI investments:

“As a consequence, major tech companies are likely to slow down AI-related spending and adopt a more milestone-focused strategy, while investors, having overcome their fear of missing out, are now opting for greater diversification.”

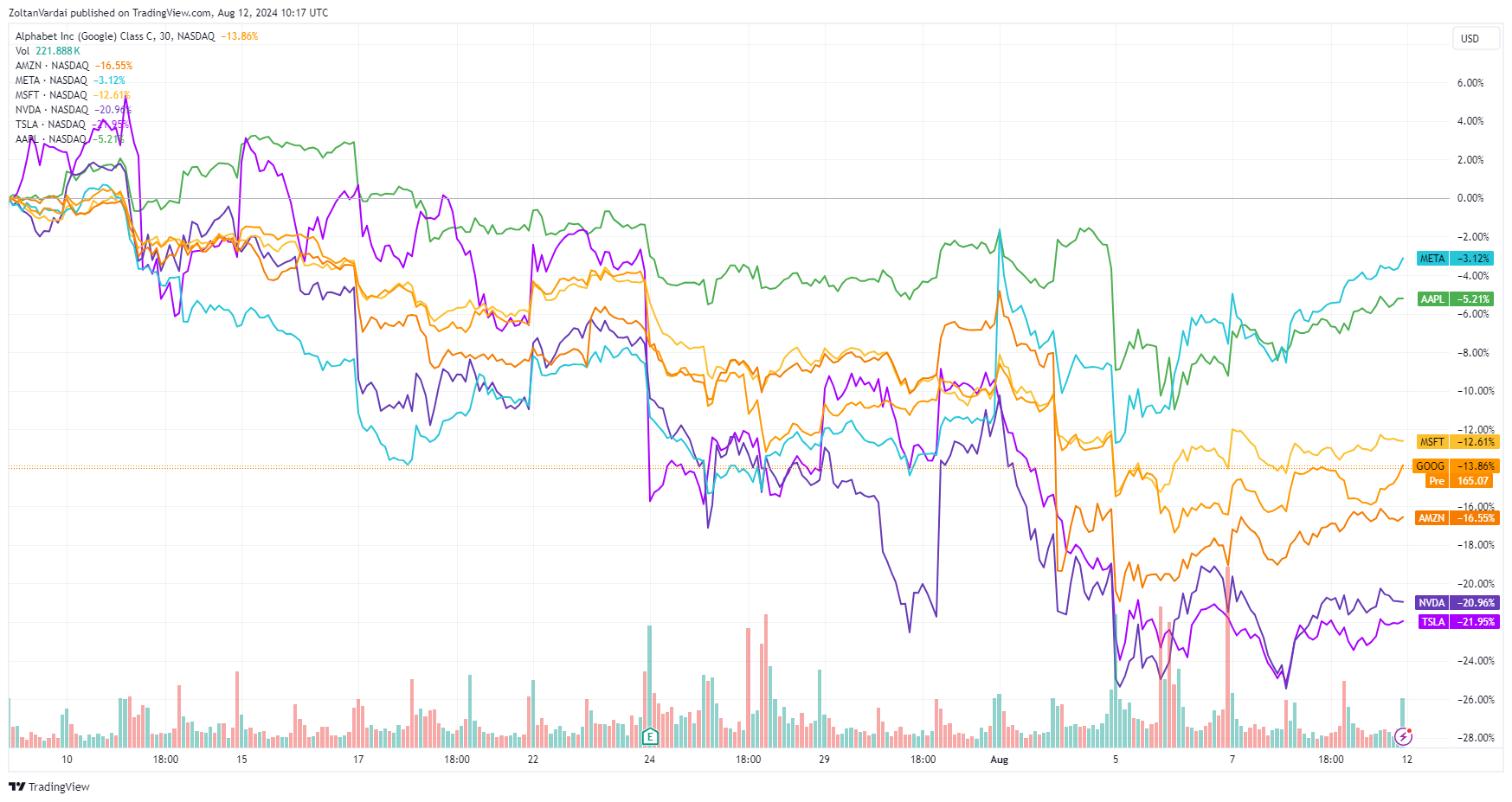

In the past month, all Magnificent Seven stocks experienced declines, with Tesla posting the largest monthly loss of over 21%, followed by Nvidia with a drop of over 20%.

Magnificent Seven stocks, monthly chart. Source: TradingView

Potential Impact on Bitcoin Prices

During a recent $510 billion sell-off in the crypto market, the Magnificent Seven stocks lost over $650 billion in combined market capitalization during regular trading on August 5th.

Akshay Nassa, founder of Chimp Exchange, suggested that another potential decline in the Magnificent Seven could negatively affect Bitcoin prices. He noted:

“The well-documented correlation between stock market performance and cryptocurrency values indicates that as major tech stocks struggle, investor sentiment typically shifts away from alternative assets like Bitcoin.”

Alvin Kan, Chief Operating Officer of Bitget Wallet, also anticipates that a further decline in the Magnificent Seven could exert pressure on Bitcoin.

Source: Cointelegraph

Comments