The recent downturn in traditional financial markets has significantly impacted cryptocurrencies, leading to a substantial decline across all major assets. What factors have contributed to this so-called “perfect storm”?

On August 2, a staggering $2.9 trillion wwiped out from stock markets, marking the worst trading day since the COVID-19 crash in 2020. The escalating fears of a recession and other factors have also affected the cryptocurrency markets, increasing fear among investors.

Snapshot from the $ 2.9 trillion crash from Aug. 2, 2024. Source: Radar Hits

Bitcoin and Other Cryptocurrencies Take a Hit

Bitcoin has experienced a 27% drop, while Ether has fallen by 34%, with over $1.13 billion in futures positions liquidated. The market’s recent activity has dramatically shifted the Fear & Greed Index from greed (74) to fear (26), teetering on the edge of extreme fear.

Fear & Greed Index from Aug. 5, 2024. Source: Alternative

Additionally, the CBOE Volatility Index (VIX), which gauges stock market volatility based on S&P 500 index options, soared to 65—the highest level since the pandemic crash—suggesting that markets could face extreme turbulence. While the factors driving this downturn are not exclusive to cryptocurrencies, they have significantly impacted Bitcoin and especially the altcoin market.

On August 5, 2024, during an emergency analyst call, Maximiliaan Michielsen, a financial researcher at 21Shares, pointed out the potential downsides of the crypto market’s unique 24/7 trading availability. He noted that “crypto was the only asset traded all over the weekend,” making it the only tradable asset as adverse events unfolded.

Factors Driving the Recent Sell-Off

The markets are expressing skepticism about global policymakers’ ability—particularly the US Federal Reserve—to control inflation without causing significant collateral damage. Several conditions have contributed to this drastic change in market sentiment.

Recession Concerns in the US Economy

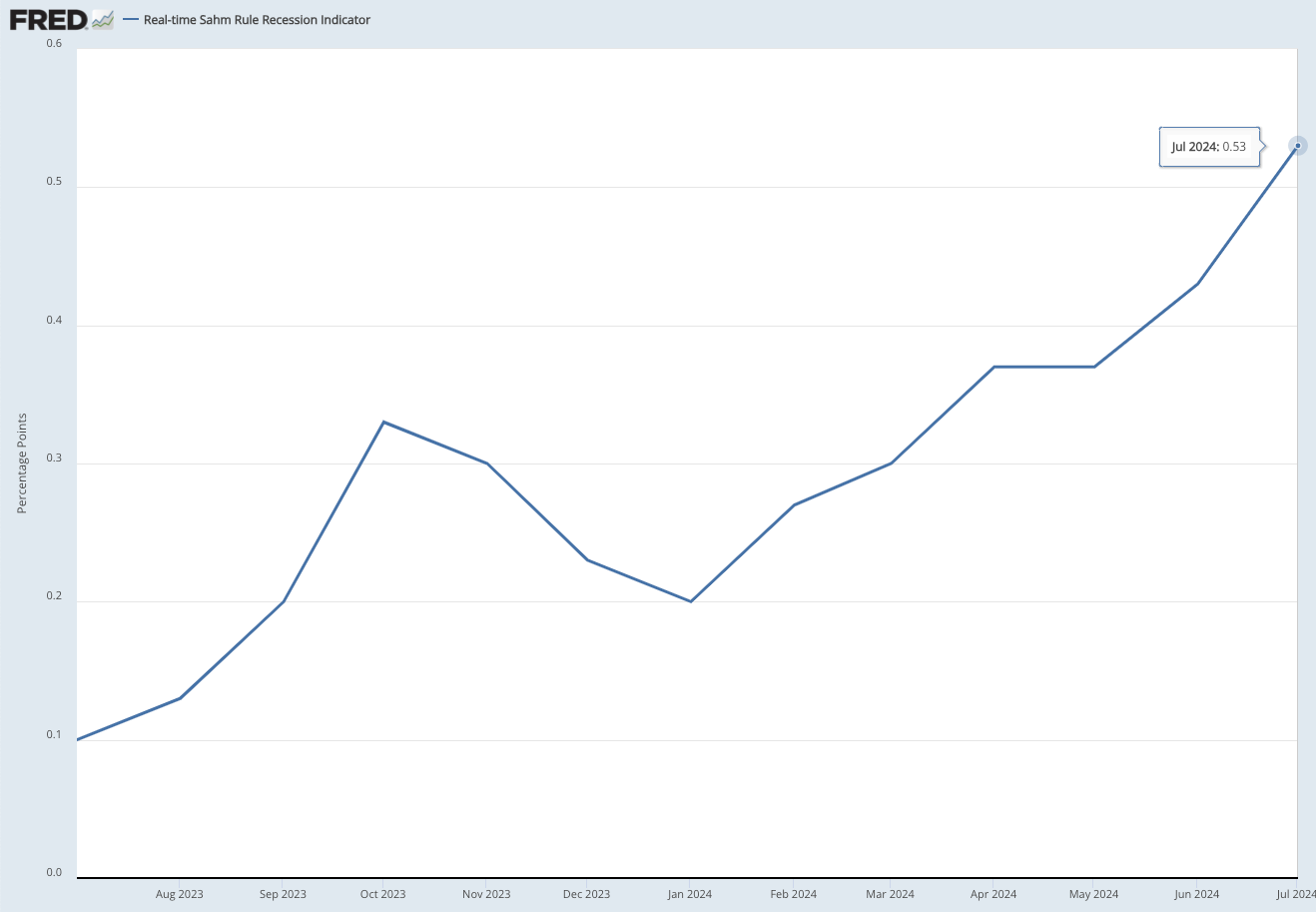

On August 2, the US nonfarm payrolls report revealed a sharp slowdown in hiring for July, with employers adding just 114,000 payrolls instead of the anticipated 175,000. Following this data release, the Sahm Rule—created by former Fed economist Claudia Sahm—rose to 0.53% from 0.43% in June, according to Fed data.

Real-time Sahm Rule Recession Indicator. Source: Federal Reserve of St. Louis

The Sahm Rule is designed to detect the onset of recessions as they begin, not as they progress. It triggers a recession signal if the three-month moving unemployment rate average increases by 0.5 percentage points or more from its 12-month low.

This indicator has successfully identified the onset of every US recession since 1970. As a result, markets may have interpreted the latest data as a potential warning of an upcoming recession and reacted accordingly. Claudia Sahm explained to Yahoo Finance that the tool was developed to alert others when to take action. Despite the negative recession signal, she believes there is still some leeway, stating, “We are not in that danger zone yet.”

The sudden market upheaval has led numerous market participants and economists to advocate for an emergency rate cut by the Federal Reserve. Jeremy Siegel, an economist and finance professor at the University of Pennsylvania, has called for a 75-basis-point rate cut, with an additional 75-basis-point reduction anticipated at the Federal Reserve’s September policy meeting.

Japan’s Yen Carry Trade Pressure

A key factor behind this abrupt market shift is the Bank of Japan’s (BOJ) decision to raise interest rates for only the second time since 2007. Although modest at just 0.25% from the previous range of 0% to 0.1%, the BOJ’s increase has sparked a significant reaction in global markets.

Since the 1990s, Japan has faced persistent stagflation, characterized by rising unemployment and inflation. To stimulate the economy, the BOJ set interest rates near 0%, fostering an environment conducive to arbitrage, known as the carry trade. Under these conditions, a common strategy involved borrowing in yen, converting to dollars, and investing in assets like stocks, real estate, or cryptocurrencies for higher returns. The key to this carry trade was achieving a yield greater than the borrowing interest rate, effectively creating the potential for almost free money and attracting many traders.

Japan’s recent interest rate increase sets a new precedent for future adjustments, potentially aligning with the trend of other global central banks implementing record-high hikes. While some traders may have managed to sell their positions in time to secure gains, many market participants may have been forced to sell in a panic to cover their operations.

Daily chart USD/Yen. Source: Trading view

Traders facing significant losses and margin calls are selling their US stocks to raise US dollars and convert them back to Japanese yen to repay loans. This sudden shift in forex trading can increase selling pressure on US stocks or cryptocurrencies in the short term.

Disappointing US Tech Reports Renew AI Bubble Fears

The latest data on the US economy, combined with shifting global forex conditions, coincided with disappointing results from tech stocks. Technology shares, a leading force in the US market, represent 42% of the S&P 500 index, a benchmark tracking the performance of the top 500 US companies.

On August 1, Amazon fell 9% after reporting weaker-than-expected quarterly revenue. Intel stock plummeted after announcing a $10 billion cost reduction plan that would lay off 15% of its workforce.

Despite positive revenue reports from companies like Meta, Apple, and Nvidia, tech stocks have been adversely affected, suggesting that investor concerns extend beyond earnings results. This has reignited fears of a potential AI stock bubble, further intensifying market anxiety and contributing to increased sell pressure.

Investors Turn to Cash Amid Geopolitical Tensions

Geopolitical tensions have affected markets since the Russian incursion into Ukraine in 2022. Despite the turbulence, markets have managed to progress. However, recent tensions between Israel and Iran have raised fears of a potential larger war in the Middle East.

The last time Iran attacked Israel was on April 15 in response to Israel’s attack on an Iranian embassy in Damascus, Syria. Following the attack, Bitcoin prices nosedived as the world faced the uncertainty of a possible war between the two countries. There is concern that a conflict between these adversaries could escalate into a broader global confrontation, given that the US is a staunch ally of Israel, while Russia and China have strategic alliances with Iran.

The extent of other countries’ involvement will depend on their willingness to engage directly in the conflict. Nevertheless, a regional conflict in the Middle East could have widespread collateral effects, particularly on nations involved in oil production, potentially impacting global markets.

Leena ElDeeb, a research associate at 21Shares, noted during an analyst meeting that despite Bitcoin’s narrative as a safe haven, it does not consistently fulfill that role. 21Shares views Bitcoin as an emerging store akin to gold; however, ElDeeb mentioned that during crises, like the current sell-off, “people don’t resort to gold; people resort to cash,” which can extrapolate to Bitcoin’s price.

Anticipating Further Bitcoin Price Correction

All these factors are putting pressure on all markets, including cryptocurrencies, where money is being converted into cash. The popular analyst Rekt Capital believes Bitcoin’s price decline could persist for two months before a new bullish chart pattern emerges, potentially leading to a breakout.

Regarding its price range, the analyst told Cointelegraph to prepare for price levels close to $40,000: “At its lowest point, Bitcoin dipped below its 50-week moving average. Without strong buyer support right now, it goes even lower, and it would trigger an even more active sell-off as it did in late 2021 and early 2022. If it doesn’t hold either, it’s worth preparing for a failure toward $42,000.”

A perfect storm appears to be brewing in the crypto market, with participants needing to take a broader perspective and stay attuned to macroeconomic events that could steer the market back into positive territory.

Source: Cointelegraph

Comments