Ether exchange-traded funds (ETFs) have officially started trading on stock exchanges, and analysts have revealed preliminary inflow data for the first 15 minutes.

Initial Performance and Inflows

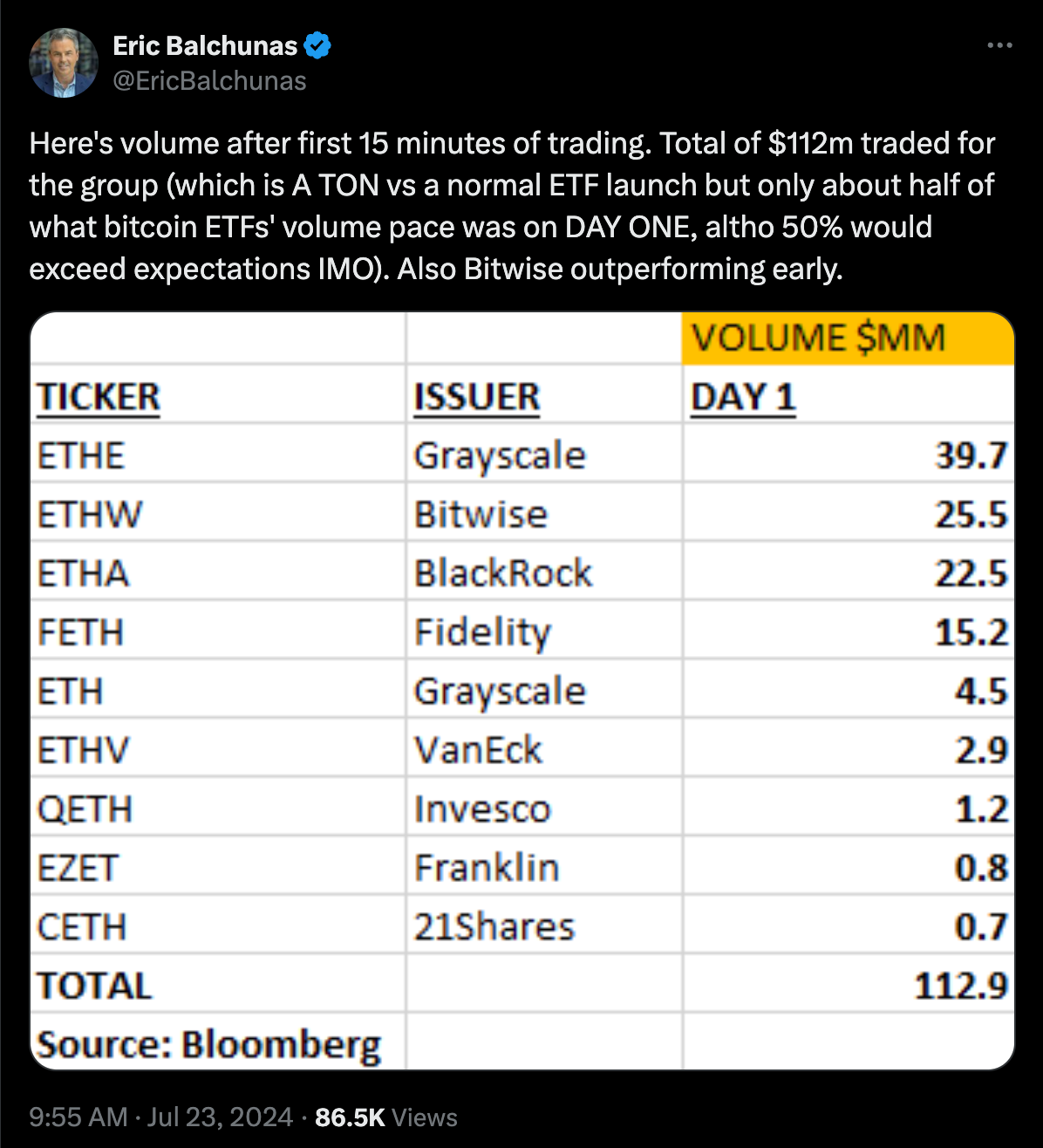

Bloomberg senior ETF analyst Eric Balchunas reported that Bitwise outperformed its competitors in the first quarter-hour of trading, recording $25.5 million in capital inflows. This performance was second only to Grayscale’s Ethereum Trust, established in 2017.

Overall, the nine Ether investment vehicles saw total inflows of $112 million within the first 15 minutes of trading, significantly surpassing traditional ETF offerings. Balchunas noted that although the initial inflows into Ether ETFs were about half of those seen on the first day of the Bitcoin ETF launch, they still exceeded expectations.

ETH/USD daily candle chart. Source: TradingView

Market Reaction

Despite the launch of the highly anticipated Ether ETFs and the substantial initial inflows, the price of Ether has fallen since the start of the trading day. Ether started the day trading at approximately $3,540, dropped to a low of $3,426, and later recovered slightly to around $3,471.

Competitive Landscape Among ETF Issuers

To attract investors, most of the nine Ether ETF issuers have reduced or waived fees temporarily, highlighting the intense competition among them.

- 21Shares: In a July 17 filing with the United States Securities and Exchange Commission, 21Shares announced it would waive fees for the first six months and then impose a 0.21% management fee thereafter.

- BlackRock: Implemented a similar fee structure, starting with a 0.12% initial management fee that will increase to 0.25% after one year or when the ETF reaches $2.5 billion in assets under management, whichever comes first.

- Bitwise: Adopted a unique approach by pledging 10% of its spot Ether profits to fund Ethereum developers in partnership with the Protocol Guild, which represents over 170 Ethereum builders.

The early success of these Ether ETFs reflects strong investor interest and sets the stage for further developments in the cryptocurrency ETF market.

Comments